The Securities and Exchange Commission (SEC) recently proposed amendments to its auditor independence rules which, if adopted, will provide greater flexibility for auditor relationships and services that technically would have triggered breaches of the current rules (even though they do not pose a threat to an auditor’s objectivity and impartiality). The SEC hopes that the amendments will reduce or remove certain practical challenges associated with the auditor independence analysis, ease compliance burdens of audit firms and issuers, facilitate initial public offerings, and increase the number of qualified audit firms that companies could select. Certain of the proposed changes reflect codifications of existing SEC staff views. The SEC release proposing the amendments to the independence framework in Rule 2-01 of Regulation S-X is available here, and the SEC’s press release is available here.

Portfolio Companies – Adding a Materiality Qualifier to the “Up and Over” Provision

One of the most significant amendments proposed is a change to the definitions of “audit client” in Rule 2-01(f)(4), and “investment company complex” in Rule 2-01(f)(14), to address affiliate relationships that may technically violate the independence rules but typically have not posed a threat to an auditor’s independence in the SEC staff’s experience. These amendments may be particularly beneficial for entities in complex organizational structures such as private equity funds and investment companies where, under the current rules, acquisitions, dispositions and/or changes to portfolio companies create significant practical challenges and monitoring burdens with respect to potentially independence impairing relationships and services.

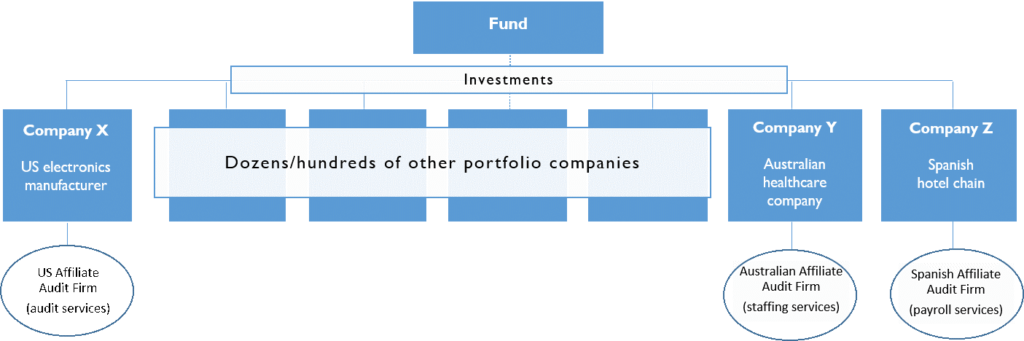

Under the current rules, entities under common control with the audit client (“sister entities”) are considered affiliates and fall within the definition of audit client to which an independence analysis must be performed, even when those affiliates are not material to the controlling entity (and each entity in an investment company complex is considered an affiliate when the audit client is part of the complex). The SEC’s press release presents the following example involving affiliated portfolio entities to illustrate concerns with the current rule that the proposal seeks to address:

Example: Fund F invests in dozens or hundreds of companies around the globe, including Company X, a US-based portfolio company. Audit Firm A is the auditor of Company X. Two of Audit Firm A’s global network affiliates provide certain short term non-audit services (e.g., staffing and payroll) to two separate portfolio companies of Fund F, Company Y and Company Z, who have no relation to each other or to Company X, except that Fund F is invested in each Company. Company Y and Z are not material to Fund F.

Under the current auditor independence rules, if Company X wants to conduct an IPO, Audit Firm A would not be independent of Company X because the non-audit services provided to either Company Y or Z are impermissible. In this circumstance, Company X, seeking to accomplish the IPO, would need to find a new auditor (if an independent one is available with the appropriate capability and expertise), delay the offering for up to three years (due to the current “look-back” requirement for IPOs – see proposal below), or obtain favorable interpretative guidance from the SEC staff. The foregoing scenario has been presented to the staff a number of times, and the staff generally has not objected to the accounting firm serving as the independent auditor. The staff has found that audit firms providing services to, or having relationships with, sister entities not material to the controlling entity do not typically present issues with respect to the audit firm’s objectivity or impartiality. According to the SEC press release, the impact of the current auditor independence rules on auditor choice (or a lack thereof) is underscored by this fact pattern and has increased significantly as the “asset management industry has grown, investments have become more global and the global audit services ecosystem has consolidated and become more specialized.”

The amendments would add a materiality qualifier to the definition of “affiliate of the audit client” in Rule 2-01(f)(4)(i)(B) and for entities under “common control” with an investment company under Rule 2-01(f)(14). Accordingly, as it relates to entities under common control, the proposed amendment includes as affiliates of the audit client only sister entities that are material to the controlling entity for the auditor independence analyses. Consequently, the proposal, if adopted, may reduce the number of entities that fall within the definition of affiliate of the audit client, thereby reducing burdens and providing more flexibility, as in the example above where, when consulted, the SEC staff did not object to the relationship. However, according to the proposing release an “immaterial” determination by the auditor does not conclude the analyses. The auditor and audit client must consider “all relevant facts and circumstances” pursuant to the general independence standard in Rule 2-01(b).

Initial Public Offerings – Shortening the Look-back Period to One Year from Three Years

Separately, proposed amendments to Rule 2-01(f)(5)(iii) are expected to provide a significant benefit to U.S. companies seeking to conduct an IPO for the first time. The proposed amendments to the definition of “audit and professional engagement period” would reduce the look-back period in which a company must establish auditor independence before an IPO from three years to one year (in conformity to the rules for foreign private issuers). Given that an IPO is generally planned with sufficient time to address prohibited relationships, according to the SEC, the one-year look back period will provide a significant amount of flexibility to companies seeking to conduct an IPO.

M&A Transactions – Providing a Transition Framework for Inadvertent Violations

The proposed amendments also address potential auditor independence violations in corporate transactional scenarios such as mergers and acquisitions, where prohibited services or relationships that are the basis for the violation were not prohibited before the consummation of the transaction. An example presented in the SEC release is as follows:

“For example, an audit firm could have an existing audit relationship with an issuer that acquires another company for which the audit firm was not the auditor but provided services or had relationships that would be prohibited under Rule 2-01. . . . [T]he acquisition would cause what had been permitted non-audit services or relationships to become prohibited non-audit services or relationships in violation of the auditor independence rules when the prohibited services or relationships occurred within the audit or professional engagement period as defined in Rule 2-01(f)(5). . . . The prospect of auditor independence issues arising as a result of a corporate acquisition transaction can have an adverse effect on the audit client, as it may result in the termination of audit work midstream or termination of the non-audit service that is in progress in a manner that is costly to the audit client. Alternatively, it could result in a delay of a merger or acquisition while the auditor and its audit client attempt to resolve the potential independence matters.”

The SEC proposes a transition framework to address these types of inadvertent independence violations. An accounting firm’s independence will not be impaired because an audit client engages in a merger or acquisition that gives rise to a relationship or service that is inconsistent with the independence rules, provided that the accounting firm:

- is in compliance with applicable independence standards from inception of the relationship or service;

- corrects the independence violations arising from the merger or acquisition as promptly as possible (and in no event later than six months post-closing); and

- has in place a quality control system to monitor the audit client’s M&A activity and to allow for prompt identification of potential independence violations before closing.

Other Proposed Amendments

The proposed amendments also (1) add certain student loans and de minimis consumer loans to the categorical exclusions from independence-impairing lending relationships, recognizing that not all creditor or debtor relationships threaten an auditor’s objectivity and impartiality, (2) replace the reference to “substantial stockholders” in the business relationship rule with the concept of beneficial owners with significant influence, and (3) implement other miscellaneous updates.

The public comment period will remain open for 60 days following publication of the SEC proposing release in the Federal Register.

Audit Committee’s Critical Role in Auditor’s Compliance with the Auditor Independence Rules

On the same day as the SEC proposal was released, the SEC Chairman, Chief Accountant and Director of the Division of Corporation Finance, issued a “Statement on the Role of Audit Committees in Financial Reporting and Key Reminders Regarding Oversight Responsibilities,” available here. Among other important reminders, the statement is a reminder to audit committees of their vital role in the financial reporting system through their oversight of financial reporting, including oversight responsibilities concerning auditor independence, as well as internal control over financial reporting (ICFR). In particular, the statement encourages the audit committee to consider periodically the sufficiency of the auditor’s and the company’s monitoring processes. The admonition in the statement that “[a]mong other items, these processes should address corporate changes or other events that could affect auditor independence (e.g., changes or events that may result in new affiliates or business relationships) and facilitate the timely communication of these events and changes to the audit firm” appears to tie to the transition framework for M&A activity described above.