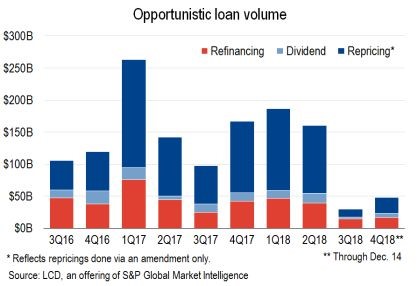

Following a refinancing slowdown in the second half of 2018 and with Q1 2019 showing the lowest quarterly level of U.S. syndicated loan issuances since Q1 2016, dividend recapitalization transactions now are back on the table.

Dividend recap activity lagged in 2018 as loan investors directed their focus to M&A-related financings.

The trend continued in Q1 2019 when M&A and LBO activity continued to dominate a reduced deal flow.

Now, it seems sponsors and lenders are revisiting dividend recapitalization transactions, helped in part by a drop in global M&A activity, relaxed Leveraged Lending Guidance and demand from institutional investors and CLO funds.

Perhaps the most prominent such transaction, Staples’ dividend recapitalization financing was revamped this morning to reflect a $2.3 billion first lien term loan, $1.275 billion of other secured debt and $1.0 billion of unsecured debt, which are expected to be allocated tomorrow. As of last week, the proposed deal terms allowed a $1 billion distribution to be paid to Staples’ financial sponsor, private equity firm Sycamore Partners. Staples was taken private in 2017. If successful, a $1 billion dividend payment will allow Sycamore Partners to recover nearly two-thirds of its original investment.

In recent weeks, other issuers have approached the market with add-on term loans or full recapitalizations, the proceeds of which will be used, at least in part, to fund sponsor dividends, including Lonestar Generation, Utopia Pipeline and LegalShield.

“Loan outflows have continued . . . but demand from CLO funds and institutional investors is offsetting this loss of liquidity and allowing borrowers to consider aggressive dividend deals as dealflow remains low.”

– Goldsheets, Thomson Reuters LPC, April 1, 2019