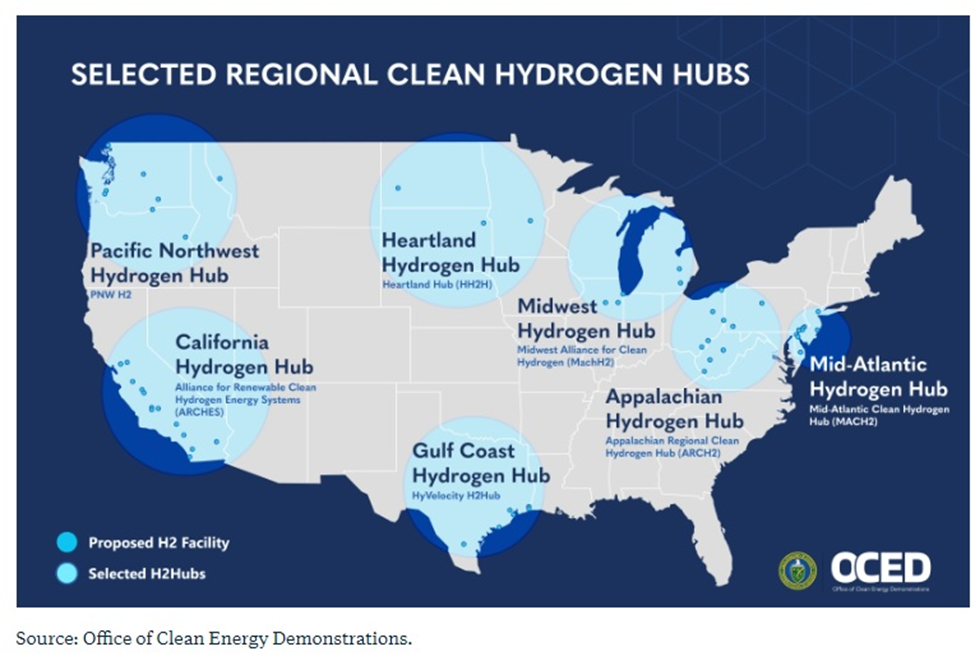

On October 13, 2023, the U.S. Department of Energy (“DOE”) selected seven regional clean hydrogen hubs (“H2Hubs”) for award negotiations to receive up to $7 billion in federal funding in accordance with the Infrastructure Investment and Jobs Act (IIJA), also known as the “Bipartisan Infrastructure Law”. The goal of H2Hubs is to accelerate the development of a low-cost, clean hydrogen market in the U.S. These H2Hubs include the Mid-Atlantic Hydrogen Hub, the Midwest Hydrogen Hub, the Pacific Northwest Hydrogen Hub, the Gulf Coast Hydrogen Hub, the Appalachian Hydrogen Hub, the California Hydrogen Hub, and the Heartland Hydrogen Hub, and collectively cover over a dozen states, including California, Minnesota, Texas and the Dakotas.

H2Hubs

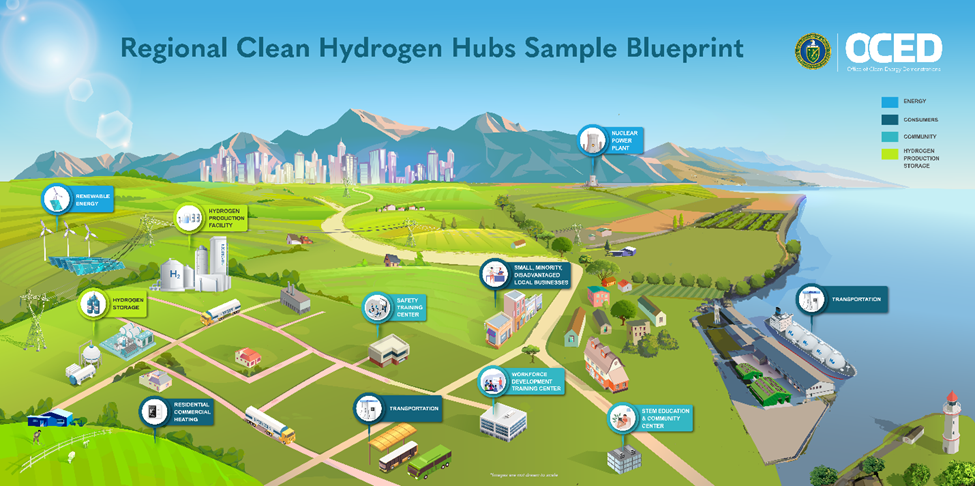

Each H2Hub is a regional network of clean hydrogen producers and consumers (and everything in between, including processing and storage), connected via local infrastructure. Locating the hydrogen value chain in the same geographic region is expected to drive down the cost of production, transportation, and storage of clean hydrogen, thereby making it more cost-competitive with conventional fuels or conventionally-produced hydrogen.

The versatility of clean hydrogen as an energy carrier and its potential to be used across industrial processes, power generation, and transportation (thereby decarbonizing these energy-intensive industries) make it important for the current administration’s goals of 100% clean electrical grid by 2035 and net-zero carbon emissions by 2050. According to the DOE, H2Hubs should generate three million metric tons of clean hydrogen annually, or about one-third of the 2030 U.S. production target. H2Hubs are expected to spur more than $40 billion in private investment and generate tens of thousands of jobs, increasing the total public and private investment in H2Hubs to about $50 billion.

Each H2Hub is backed by a varying combination of state government leaders, industry partners, non-profit organizations, utilities, academia, and organized labor, among others. Buy-in from relevant local and community stakeholders will be important for the successful development of an H2Hub. Additionally, to receive federal funding under the Bipartisan Infrastructure Law, each H2Hub must provide at least 50% non-federal cost share, meaning that at least 50% of the total project cost for an H2Hub (including DOE share and recipient cost share) will need to come from non-federal sources (unless otherwise allowed by law), such as project participants, state or local governments, or other third-party financing. H2Hubs participants will need to carefully navigate the cost-sharing requirements, including acceptable forms of H2Hubs cost sharing (cash, cash equivalents, or in-kind contributions). Other federal financing, such as DOE Loan Guarantees, cannot be used to provide the required H2Hub cost share or to otherwise support the same scope that is proposed under an H2Hub.

Diversification is key, from geographic location to production methods and end uses

The Funding Opportunity Announcement for Regional Clean Hydrogen Hubs (“FOA”) issued by the DOE’s Office of Clean Energy Demonstrations (OCED) in September 2022 noted that diversification in terms of production (feedstock and technology), end-use and geography will all play a considerable factor for selection of H2Hubs, and that is apparent in the selections made last week. Each H2Hub focuses on distinct end-use cases and production techniques, and covers different geographic region of the U.S. See the Table 1 below which provides a general overview production feedstock and technology and end-use for clean hydrogen produced by the applicable H2Hub.

Table 1: H2Hubs Production Methods and End-Use Summary*

| # | H2Hub | Region | Production Feedstock and Technology | End-Use | Award Amount |

| 1 | Appalachian Hydrogen Hub (ARCH2) | West Virginia, Ohio, and Pennsylvania | Natural gas coupled with carbon capture and storage (blue hydrogen) | Industrial, transportation | Up to $925 million |

| 2 | California Hydrogen Hub (ARCHES) | California | Renewable energy and Biomass (green hydrogen) | Public transportation, heavy duty trucking, and port operations | Up to $1.2 billion |

| 3 | Gulf Coast Hydrogen Hub (HyVelocity H2Hub) | Texas | Mixture of natural gas and carbon capture (blue hydrogen) as well renewables-powered electrolysis (green hydrogen) | Fuel cell electric trucks, industrial processes, ammonia, refineries and petrochemicals, and marine fuel | Up to $1.2 billion |

| 4 | Heartland Hydrogen Hub (HH2H) | Minnesota, North Dakota, and South Dakota | Renewable and nuclear power using electrolyzer technology (green and pink hydrogen) | Industrial operations, ammonia and urea fertilizer production, and natural gas blending for power generation | Up to $925 million |

| 5 | Mid-Atlantic Hydrogen Hub (MACH2) | Pennsylvania, Delaware, and New Jersey | Renewable and nuclear power using electrolyzer technology (green and pink hydrogen) | Industrial, building heat, aviation, distributed power, public transport, trucking, commercial fleet, port operations | Up to $750 million |

| 6 | Midwest Hydrogen Hub (MachH2) | Illinois, Indiana, and Michigan | Renewable and nuclear powered electrolysis (green and pink hydrogen) and natural gas coupled with carbon capture and storage (blue hydrogen) | Transpiration, aviation, industrial (steel and glass production), agriculture | Up to $1 billion |

| 7 | Pacific Northwest Hydrogen Hub (PNW H2) | Washington, Oregon, and Montana | Renewable powered electrolysis (green hydrogen) | Maritime, aviation, industrial | Up to $1 billion |

The selection of these H2Hubs confirm that the DOE is not solely focused on green (renewable) hydrogen. In fact, only two of the H2Hubs will exclusively produce green hydrogen. The rest of the H2Hubs will be producing a mixture of blue (fossil fuels coupled with CCS), green (renewables) and pink (nuclear) hydrogen, with the exact proportions of each hydrogen type at each H2Hub unclear at this stage. The selected hubs appear to reflect the diversification of hydrogen production technologies that the Bipartisan Infrastructure Law has called for.

Demand is key

The major piece of the puzzle is ensuring that there is demand and guaranteed off-take for such clean hydrogen produced by the H2Hubs. “Build and demand will come” is not a strategy that can be employed in these capital-intensive projects, and lenders will expect to see a long-term off-take agreement to make a clean hydrogen project financeable. As H2Hub participants begin detailed negotiations with the DOE and secure funding agreements, more specifics about the projects, including off-take arrangements, should become clear.

In addition to the H2Hubs, the DOE is also working on the demand side for the H2Hubs. Earlier this year, it released a Request for Proposal (accessible here, and due on October 26, 2023) to (i) de-risk projects associated with H2Hubs by creating a medium-term demand certainty, (ii) accelerate commercialization of clean hydrogen projects, and (iii) demonstrate the viability of its end-uses. This strategy is to address a fundamental problem with scaling up clean hydrogen technology – early deployment depends on demonstrated demand, which is difficult to achieve while costs are still high and markets are still developing. DOE hopes that these demand-side programs will lead to early deployment, resulting in cost reductions. While this demand-side FOA is seeking “non-government, U.S.-based, not-for-profit entity or entities” for the primary selection, for-profit entities could be included in the partnering organization(s).

Next Steps to receive DOE funding

The selections of H2Hubs announced by the DOE last week are for award negotiations with the goal of entering into funding agreements by the end of the first quarter of 2024. More specifics about the projects included in each H2Hub and the commitment of each H2Hub participant will be determined as part of this process. As such, the selection of an H2Hub last week is not a commitment by DOE to issue an award. DOE has the right to halt talks and withdraw an H2Hub’s selection at any point throughout the negotiation process.

Further, entering into a funding agreement with the DOE does not guarantee receipt of the full award amount. Each H2Hub development has been divided by the DOE into four phases: phase 1 (planning and analysis to ensure the H2Hub concept is technologically and financially viable); phase 2 (finalization of engineering design, permitting and key agreements, including site access, labor agreements and off-take); phase 3 (installation, integration and construction); and phase 4 (ramp up to full operations). Each phase has deliverables associated with the required activities in such phase, which DOE will review and use to determine whether to continue to fund the development of the current or subsequent phase for such H2Hub (also referred to as “Go/No-Go decisions” in the FOA). DOE will initially authorize funding of up to $20 million per H2Hub for phase 1, subject to the 50% minimum cost sharing requirement described above.

Funding agreements with the DOE, as well as various federal regulations, will impose certain federal procurement requirements on H2Hub participants (many of which may flow down from the prime contractor to its subcontractors, consultants and certain other parties) which should be carefully analyzed by prospective participants and private investments in the H2Hub projects or acquisitions or divestments thereof. Potential participants who have no experience with federally financed projects should seek legal advice early in the process so they are prepared to execute documents that may depart significantly from the type of commercial agreements with which they are more familiar.

The selection of H2Hubs is certainly continuing the momentum that clean hydrogen is experiencing in the U.S. and around the world. In addition to DOE negotiations, H2Hubs will need to focus on attracting private investment required as part of H2Hubs minimum 50% cost share. Commercially viable clean hydrogen projects in the U.S. are likely to move forward regardless of whether they are affiliated with these H2Hubs, given the much more significant incentives provided by the Inflation Reduction Act of 2022 (IRA). The next big development in the hydrogen community is the much awaited guidance from the Department of Treasury and the Internal Revenue Service with respect to §45V clean hydrogen production tax credit (and the associated clean hydrogen production incentives in §§45 and 48), which is due by the end of 2023 and will have a more significant impact on the development of domestic hydrogen production than the H2Hubs program.